The world has changed, but we still teach and discuss theories that are essentially justifications of business as usual, ignoring the dramatic new challenges we face. A new generation of economists is building what we can call real-world economics.

(Ladislau Dowbor)

Economists are becoming conscious of the unsustainability of the present social and fiscal model.

(Thomas Piketty, Le Monde, May 7, 2023)

Rising debt service (interest and amortization) diverts spending away from goods and services, shrinking the economy and thus reducing investment and new hiring.

(Michael Hudson, J is for Junk Economics, 2017, p.258)

We have been hanging on to the most curious, and often ridiculous experiments in economic analysis, some even consecrated with the Bank of Sweden Nobel Prize (not a formal Nobel prize) like Milton Friedmann, with people gasping at the depth of his simplicity: “The business of business is business”, as if it meant anything beyond free-for-all corporate behavior. Mathematical models gave an appearance of serious science to what has become, in Michael Hudson’s words, “junk economics”. It seems economics is presently coming down to earth. And looking back, it is impressive how long we kept (and still keep) in absurd simplifications. Basically, that if everyone of us centers on grabbing as much as he can, the result will be greater overall prosperity. How rational is the Greed is Good slogan?

Humanity is ready to believe mostly anything, and to transform beliefs in dogma if they feel companions by their side. Collective bestiality surges with such strength, and so often finds scientists ready to support it with arguments. These arguments are rational, but built on top of absurd assumptions, like the invention of homo economicus, the rational profit-maximizing individual. Giving free wheels to inner tensions and being able to cover them with arguments generates an impressive feeling of liberation. Jonathan Haidt called it “the righteous mind”, justifying about anything. If we do nowadays react to the Ku-Klux-Klan absurdities, or the Nazi Deutschland Über Alles (with Gott Mit Uns, of course), so many bought the “domino theory” justifying the invasion of Vietnam, or the “weapons of mass destruction” narrative to justify the invasion of Iraq, or the military dictatorships in Latin America supposed to save us from communism. It is hard to open anyone’s mind, if his emotional comfort depends on keeping it closed. And economic interests can so easily be wrapped up in scientific arguments, if possible complex enough to avoid people having a closer look. In fact, economic theory became mainly a justification of private interests, disguised as science. J.K. Galbraith called it “the economics of innocent fraud”.

“Out of pecuniary and political pressures and fashions of the time, economics and larger economic and political systems cultivate their own version of truth. This has no necessary relation to reality.” (Galbraith, p.x) The “no necessary relation to reality” is part of Galbraith’s soft ironical approach. But he can be more direct: “Executives of the spectacularly bankrupt Enron were a prominent example, as were those of the reputable General Electric. Generous reward to management extends throughout modern corporate enterprise. Legal self-enrichment in the millions of dollars is a common feature of modern corporate government. This is not surprising: managers set their own compensation.” (27) Well, it is the market! “Belief in a market economy in which the consumer is sovereign is one of our most pervasive forms of fraud. Let no one try to sell without consumer management control.”(14) Our economic progress is supposed to be summed up in the GDP figure: “But from the size, composition and eminence of the GDP comes also one of our socially most widespread forms of fraud…The more than minimal fraud is in measuring social progress all but exclusively by the volume of producer-influenced production, the increase in the GDP…Not education or literature or the arts but the production of automobiles, including SUVs: Here is the modern measure of economic and therewith social achievement.”(15)

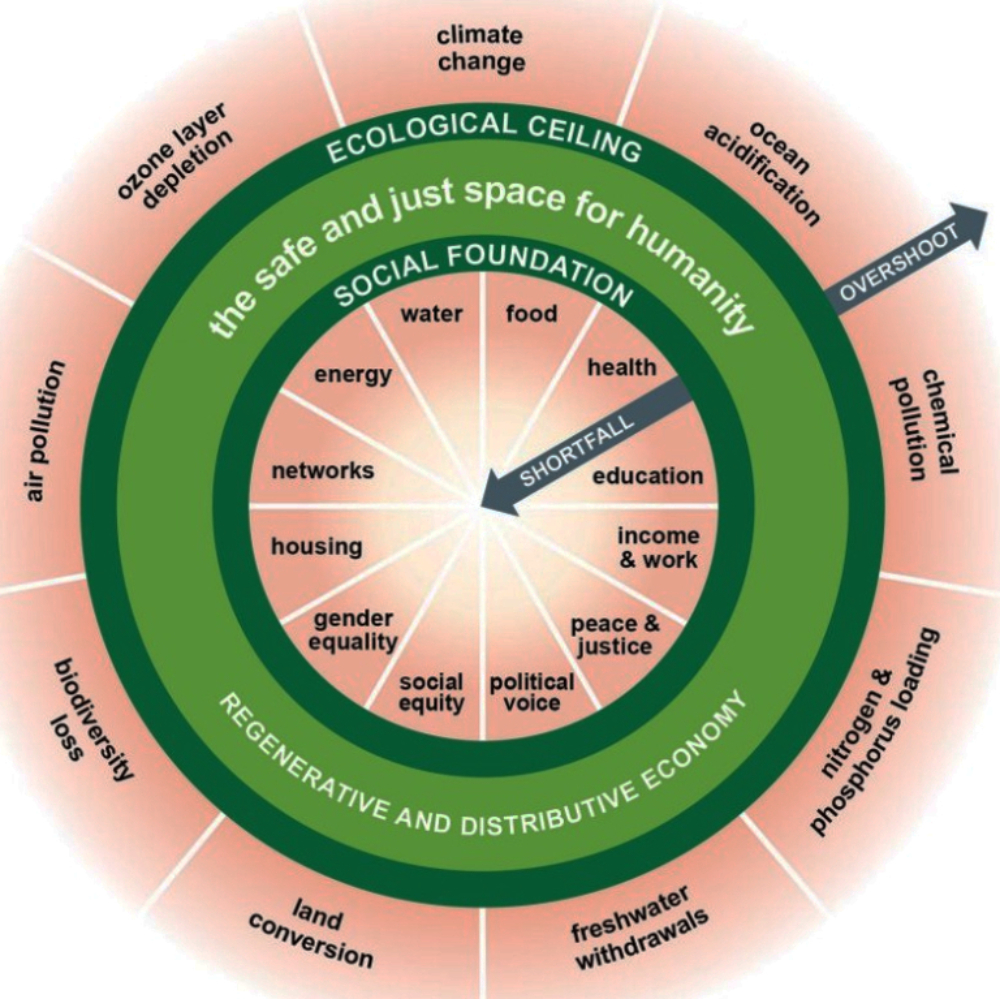

The Doughnut. Graphic by Kate Raworth and Christian Guthier/The Lancet Planetary Health

In a similar critical approach, according to Kate Raworth, economies must “make us thrive, whether or not they grow.” In this simple image, we have the doughnut, the safe place we should be, the shortfalls in the middle and the excesses we must reduce outside the circle. Putting results instead of speed in how we measure progress is a deep change in what we see economics useful for. She presents more views in her Doughnut Economics: seven ways to think like a 21st century economist, but bringing economics to what we need, and not the other way around, is a deep shift.

Robert Skidelsky, with What’s Wrong with Economics, is another scholar pointing to new trends. He suggests a “radical rethinking of methodology”, where “central topics would be the role of the state, the distribution of power, and the effect of both on the distribution of wealth and income…Further, my textbook would make clear that the only defensible purpose of economics is to lift humanity out of poverty.” (193) And if economics is to be useful today, “it will need to modify its belief in the self-regulating market.” Financial fortunes are booming, but “future historians, looking back, might well identify finance-led globalization as the root cause of the tribulations of the twenty-first century.” This is not just about growth, but about what we produce, for whom, with what environmental impacts. And it brings economics back to its place, as just a part of social sciences, in a systemic approach: “It’s because economics is not a science that it needs other fields of study, notably, psychology, sociology, politics, ethics, history to supply the gaps in its method of understanding reality…The task is no less than to reclaim economics for the humanities.” (78)

Thomas Piketty had an important role in this reset of economic thinking. Analyzing Capital in the 21st Century, he showed a key shift in the present economies: production of goods and services grows around 2.5% a year, while financial investments pay between 7% and 9%, which simply means that the financial system is draining the productive activities. Financialization became not only evident, but throughout the world economists shifted their attention to a set of transformations that resulted from it. In his more recent studies, Piketty showed how this changed the relation between economic (and particularly financial) power and political power. With contributions of the WID (World Inequality Database), and economists like Gabriel Zucman, we are presently able to have a much clearer understanding not only of the dramatic increase in inequality, but how virtual money (97% of liquidity nowadays are just magnetic signs, not government-printed money) allows for gigantic wealth drains.

This is not about markets, even if we call them so. It is about radically concentrated power. Larry Fink, head of BlackRock, an asset-management corporation, manages US$10 trillion; the federal budget of the United States of America is US$6 trillion. The tail is wagging the dog. Understanding the financial unproductive drain on the economy is leading to a wide set of studies on systems of distribution, taxing, funding for public services like health, education, environmental policies. In particular, the governance gap between the financial flows, a global scale process, and financial regulation, fragmented among so many countries, has become evident. Tax evasion is gaping, and in such close spaces as Delaware. What has become evident, is that we presently have neither market regulation (the world-scale corporate giants like the name, “markets”, as if they were obeying it) nor government regulation (any effort to regulate at the national level leads to the corporation shifting it fiscal residence location).

The overall result is that we are facing the convergence of an environmental catastrophe, explosive inequality (both at national and international levels), and a chaotic and opportunistic management of the financial resources, which should precisely be helping us fund the ecological and social challenges. We need a society that is not only economically viable, but also socially fair and environmentally sustainable. This triple bottom-line is becoming obvious in wide circles, and has been detailed in the Sustainable Development Goals. But can we organize he economy according to goals? The basic shift should be in concentrating on how we are to migrate from free-for-all corporate world scale profit maximizing, to an economy that is socially and environmentally useful, or at least less destructive. Practically all corporations claim their adherence to ESGs, which means they are conscious of the challenges, but they keep it in the public relations departments. It is not a lack of understanding, but a fault in the corporate decisions making process. Governance is the central issue.

Mariana Mazzucato has been particularly successful in spreading this new real-world economics vision, both in her The Entrepreneurial State and in Mission Economy. Instead of corporate reckless profit-maximizing along with timid public regulation, we should concentrate on the key issues humanity faces, particularly the social and environmental dramas. These are the challenges, and public policies, corporate initiatives and civil society organizations must be brought together to jointly face them. The example she uses is the race to the moon mission, which organized contributions of different sectors, generating synergy instead of competition. Mazzucato thus shows not only the key role of the public sector in providing goods and services, (the State as entrepreneur) but also its role in promoting the convergence of efforts around national and international priorities.

Michael Hudson’s J is for Junk Economics reads smoothly, a good-humored description of what he called “the 22 most pervasive economic myths of our time”, such as that business cycles are cured by the economy’s automatic stabilizers, that privatization is more efficient than public ownership and management, that there is no such thing as unearned income, that deregulating the financial sector swill free it from paperwork and enable it to pass the cost savings on to its customers and other prevailing myths. “The antidote to this junk economics must explain why economies tend to become more unstable and more polarized as a result of their own internal (“endogenous”) dynamics – above all, credit and debt dynamics, and the untaxing of unearned economic rent.” (267) For each myth, Hudson presents “Reality”.

A particularly well-structured analysis of the global shift in economic analysis is presented by Brett Christophers, in Rentier Capitalism (2020) as well as in Our lives in their portfolios: why asset managers own the world (2023). The basic argument consists in the fact that making money (big money) results essentially from financial drains, not production. Credit and financial assets management, appropriation of natural reserves, intellectual property, digital platforms, service contracts, infrastructure licensing fees, ground rent – have the common characteristic of making money on existing products and capital, not on production. They are not adding to our production capacity, they are draining it.

Whether it is about outright fraud in economic analysis as Galbraith presents it, or the shift in how we measure results that exposes the absurdity of the GDP-centered accounting, or Skidelsky's analysis on how economics has lost its link with what we need the economy for, Piketty's powerful analysis on the meaning of capital itself, Mazzucato's approach on rescuing the capacity of the State in defining missions and organizing rational convergence of efforts, Hudson`s showing how economics (so-called orthodox economics) has lost touch with reality, Christophers synthesis on how productive capitalism has migrated towards financial rent-extracting capitalism – the overall image I build in my mind is of a global shift on how economists are approaching our new realities. And they are new.

I like Robert Reich's direct approach, in The system: “There can be no responsibility without laws that force corporations to sacrifice some shareholder gains for the benefit of workers, communities, and society. And they'll understand that laws themselves are meaningless if large corporations can continue to violate them whenever the resulting fines are lower than the benefits derived from their illegality. They`ll see that the current American system is not a meritocracy where ability and hard work are rewarded but a cruel sham dominated by wealth and privilege.” (189)

So many more authors could be mentioned here, from Joseph Stiglitz on New rules for the 21st century, to Michael Sandel on The tyranny of merit: what`s become of the common good?, but the key issue is that the interest-led fairy tales on the markets, on trickling-down, or that the search for individual gains will naturally bring about social prosperity are being left behind, while a new real-world economics is giving us new tools to face our challenges: the environmental catastrophe, explosive inequality, and the financial chaos.