What matters is long term sustainable and balanced growth for all of us. Corporations are running after immediate results for the 1%, generating systemic disasters for society and for the natural world. And they support political calamities if it suits their interests. It is not “just business”. We are facing a structural flaw, and no ESG claims will help.

(Ladislau Dowbor)

If economics has a law worthy of the name, it is that firms prefer to merge than to compete.

(The Economist, April 6, 2019, p. 61)

It used to be called ‘slow-motion catastrophe’. It certainly isn’t slow-motion anymore. In the 1984 Orwellian tradition of the hate-meetings against Goldstein, our emotions have been channeled against highly visible personalities at the top, the Hitlers of different times, presently even the hitlerzinhos like Bolsonaro in Brazil or Trump in the U.S. But Hitler got to the top after the meetings and support of the Ruhr corporate giants, Krupp and others. IBM had no trouble in ensuring the German concentration camps management system. Just business. There will always be demagogues ready to become dictators, but dictatorship only exists on top of a structured power system. Reading the story of Charles Koch building political power on top of the Koch Industries economic super-power is sobering: money for organized political influence as long-term investment is changing what we used to call democracy. This is much more than a Trump/Biden issue, it is about structural change in how our societies work. Beyond the fascist assholes we elect, we have to look at who supports them.

Inequality is a drama not only because it generates so much suffering among the poor. No democracy can survive once deep inequality is reached. Tom Malleson states it very simply: “The superrich undermine democracy… Recall the tremendous influence that the Koch brothers have had over the American politics – spending hundreds of millions of dollars through a vast network of shadowy private foundations and conservative think tanks and acting as key players in mobilising the anti-tax Tea Party movement.”1 The desperate poorer half of the populations ends up supporting far right populism, and we can see it in so many countries. Political opportunism navigates freely on frustration and despair.

Wolfgang Streeck has it right when he writes that it may not be the end of capitalism, but it is the end of democratic capitalism. So many corporations, in the U.S., for example, are interested in the military investments. “These projects may make little sense from the U.S. national interest perspective, but they make lots of sense from the business growth of these organisations and institutions within the competitive security and war market of the U.S. military defence sector.” 2

The permanent international insecurity generated, with the 750 military bases the U.S. manages in the world, not to speak of arms sales and political submission of so many countries, is directly linked to the giant and highly privatised military sector: “Expenditures linked to the American army in 2024 will reach abound U.S.$1.5 trillion, approximately U.S.$ 12 thousand per household.” No president has the power to revert the process, as we saw with the Vietnam war, where four successive presidents, although convinced it was not winnable, continued to support it. Barbara Tuchman gives us all the details on this, and calls it “the march of folly”, and there is powerful logic in it. We are stuck in a power wielding machine which generates huge costs, huge suffering, but also huge profits. All this money could be used in another way. Corporate voice is simply stronger.

Permanent chemical contamination, the PFAS? Mike Ludwig analyzed DuPont and 3M: “These companies knew for decades that they were poisoning the world; they knew that these chemicals were incredibly persistent, they knew these chemicals were getting into people’s blood, they knew their workers were getting sick, they knew these chemicals were contaminating nearby communities, and they lied about it for years… Not just Americans, every single creature is paying the cost for that. It’s in our blood and wildlife, it’s in the Arctic, it is everywhere — and that is purely because of corporate greed.” 3 These corporations have been facing legal challenges in the last two decades, and paying armies of lawyers. These legal costs are incorporated into the prices we pay for their products, and their lawyers are pushing for their payments to be tax deductible.

Plastics pollution? “The branded half of the plastic was the responsibility of just 56 fast-moving consumer goods multinational companies, and a quarter of that was from just five companies. Altria and Philip Morris International made up 2% of the branded plastic litter found, Danone and Nestlé produced 3% of it, PepsiCo was responsible for 5% of the discarded packaging, and 11% of branded plastic waste could be traced to the Coca-Cola company… However, while many of these companies have taken voluntary measures to improve their impact on plastic pollution, the experts behind the study argue they are not working. Plastic production has doubled since the beginning of 2000, and studies show only 9% of plastic is being recycled.” 4 Plastic litter is everywhere. Can we, consumers, avoid it? The corporations say we are the ones who should act responsibly.

David Boyd, UN Rapporteur, does not hide his despair in the face of “a system that is absolutely based on the exploitation of people and nature. And unless we change that fundamental system, then we’re just re-shuffling deck chairs on the Titanic… It has driven me crazy in the past six years that governments are just oblivious to history. We know that the tobacco industry lied through their teeth for decades. The lead industry did the same. The asbestos industry did the same. The plastics industry has done the same. The pesticide industry has done the same. I can’t get people to bat an eyelash. It’s like there’s something wrong with our brains that we can’t understand just how grave this situation is. I think the right to a healthy environment is actually the foundation that we require to enjoy all other human rights. If we don’t have a living, healthy planet Earth, then all the other rights are just words on paper.” 5

Corporate responsibility? ESG? Are we supposed to read the tiny letters on the products we buy? Well, CEOs in the U.S. are paid 350 times the average workers wage. They bond it with shareholders, who confirm their earnings, if they maximize the dividends. One hand washes the other. We talk about democracy, but power is in the corporate world, and the 1 percent rule.

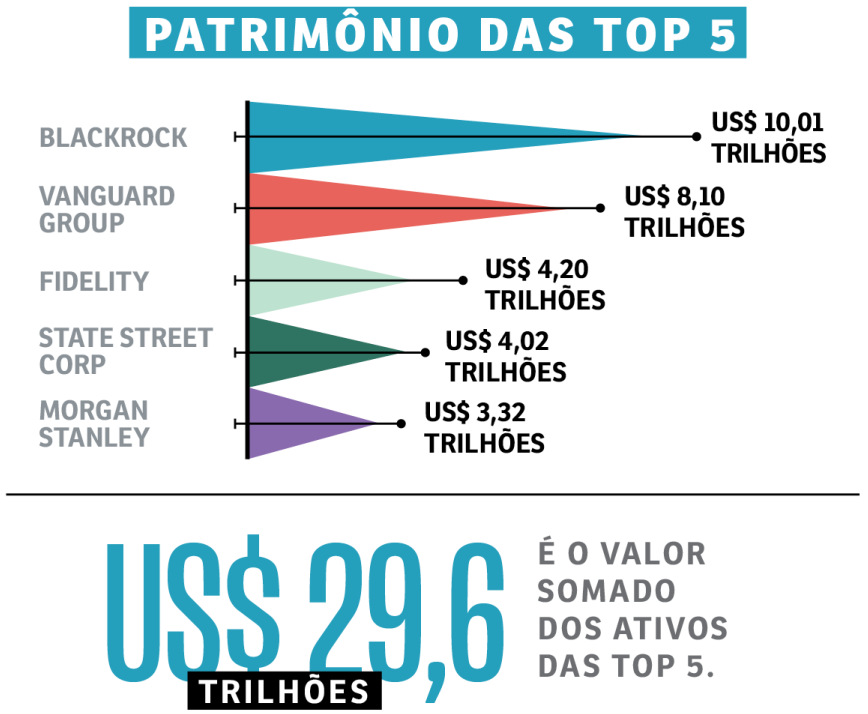

Monbiot is right in his skepticism concerning democracy. U.S. federal budget, the money Biden has to face a fight over where how every billion is used, is around 6 trillion dollars. Larry Fink, at BlackRock, manages 10 trillion, and puts the money where algorithms show dividends will be maximised, in the short term, whatever the economic, social, and environment impact. The five major asset management corporations manage nearly 30 trillion, more than U.S. GDP. 6

ESG is present in every communication. But “the Capgemini report itself provides a data point demonstrating the actual state of sustainability in business: ‘Investments in sustainability initiatives remained flat between 2022 and 2023 and represented less than 1% of total revenue in 2023, while marketing budgets were equivalent to 9.1% of annual revenue on average.' In other words, companies invest almost 10 times more in marketing than in sustainability.” 7 We are pushed to more consumption, and these 9.1% for marketing is in the prices we pay for the products. It’s another snowball in everybody’s sight, but not in the corporate algorithms' sight.

We are facing huge corporations, with world-scale impact, but narrow aims. People with a Santa Claus approach to business would consider these are just bad apples, or a liberal approach. But The Economist goes straight to the point, in referring to “the bad smell hanging over a number of powerful companies: Boeing faces claims that is sold 737 MAX planes with dangerous software. It says it is ‘taking actions to fully ensure the safety of the 737 MAX’. Criminal charges have been filed against Goldman Sachs in Malaysia for its role in arranging the $6.5billion of debt for a state-run fund that engaged in fraud. Goldman says it is co-operating with investigators.

A jury in California has just found that Monsanto failed to warn a customer that its weed killer could, allegedly, cause cancer. Bayer, a German firm which bought Monsanto in June, says it will appeal the verdict. Wells Fargo, one of America’s biggest banks, has admitted creating 3.5million unauthorized bank accounts. It says it is working to ‘rebuild trust with our stakeholders’. Facebook is ensnared in scandals; its data practices have come under scrutiny in several countries. The firm says ‘we need a more active role or governments regulators.’” 8 This was in 2019, before other Boeing planes lost a door or wheels during flights.

The OxyContin, sold as opioid painkillers, has already killed hundreds of thousands in the U.S. The Sackler family, owners of Purdue, are being sued, but the money it made generated fortunes for Johnson&Johnson, AmerisourceBergen, and Walmart. The companies are shelling out more than $50 billion total in settlements from national lawsuits. According to The Economist, at 50,000 overdose deaths a year and rising, America’s opioid crisis has never been worse. They keep selling, huge distributors make money on it, pay the fines – peanuts compared to profits – and keep killing people without having to admit guilt. It is part of the brave new “settlements” world. 9

I have brought just a few examples here, but they are not bad apples. They are the system. Some may remember the Libor scam all big European banks participated in. Bayer and others continue to produce chemicals forbidden in Europe, as they are authorized to sell them abroad, among others to Brazil, where agribusiness supported the election of Bolsonaro. So, it is alright if you are poisoning other nations. The GAFAM invasion of our minds expands, while governments run after possible regulations, to reduce what Max Fisher rightly called The Chaos Machine. And all of them generate dividends extracted by BlackRock and other asset management structures seen above. All of them also extensively use tax havens so as to escape not only from taxes, but from information on the financial flows. We have a global corporate financial governance system, and Bilderberg meetings, but no global government or regulation. It is a global mess, taking us down the drain.

Marjorie Kelly goes to the point: “The real problem is excess wealth — like the eight billionaires who own half the world’s wealth. But the culture of our economy in general supports, in fact mandates, maximum wealth extraction… What’s happening is a vacuuming upward. Financial assets have become a giant sucking action squeezing consumer pocketbooks, creating unemployment, pushing housing prices to unreachable heights, creating monopolies that hampers family businesses, blocking our ability to tackle climate change, destabilizing the economy with stock market booms and busts. And enabling billionaires to capture democracy… Businesses need to make a profit to survive, but maximising unleashes damage to society and destruction of the Earth.” 10

This is not about Trump, or Bolsonaro, or Milei, or Orban, or so many demagogues ready to kiss corporate asses. It is about the corporations that create the ground for them.

Notes

1 Tom Malleson, Against Inequality, Oxford University Press, 2023, p. 123; Christopher Leonard, Kochland, Simon&Schuster, 2019.

2 Wolfgang Streeck, O que nos separa de um novo conflito global, Outras Palavras, June 6, 2024.

3 Mike Ludwig, Truthout, June 6, 2024.

4 Sophia Quaglia, Survey finds that 60 firms are responsible for half of the world’s plastic pollution, The Guardian, April 24, 2024.

5 Nina Lakhani, UN expert attacks ‘exploitative’ world economy, The Guardian, May 7, 2024.

6 Alexandre Versignassi e Camila Barros – Os donos do mundo, September 11, 2023 - VC S/A.

7 Raz Godelnik, The business case for sustainability is not working, Medium.com, May 31, 2024.

8 The Economist, The new age of corporate scandals, April 6, 2019, p. 51.

9 The Economist, The roots of America's opioid epidemic, 2021.

10 Marjorie Kelly, The only solution to wealth-supremacy is a democratic economy, Truthout, January 22, 2024.