Can you send money to a phone number? Yes, you can send money to any mobile number. One can use the money to make payments, to send money to another mobile number, deposit to a bank account, or withdraw the money as cash. That is Mobile Money, focused on providing financial services and facilitating transactions through mobile devices.

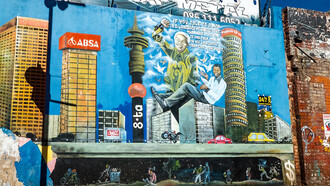

Extending the reach of financial services in emerging markets is a challenge and opportunity for traditional banks. Telcos have led the relatively recent development of mobile money products with great success; achieved through the use of innovative technology and agents on the ground.

M-PESA is a good example. M-PESA is a mobile payments system developed in Kenya which effectively offers a banking system based on mobile phones. The name comes from the Swahili 'pesa' meaning money. The original idea began as a development aid project by the UK’s Department for International Development (DFID), the foreign aid arm of the British government to enable micro-finance repayments.

Launched in 2007, it is now used in Afghanistan, Tanzania, South Africa, Bangladesh, Pakistan, India, and Romania. GCash in the Philippines allows users to pay bills, send money, and shop online. Estimates suggest that the system processes more payments than Western Union does across its entire global network. Mobile Money for the Unbanked (MMU) indicates that around 80 similar services are now in operation around the world.

Mobile money customers are able to, by using their mobile phones, pay bills, and make and receive money transfers. Local merchants are used as agents and ‘mini branches' or ATM’s for the financial institutions with the role of facilitating the registration of new customers and serving as cash deposit and withdrawal access points.

The system is simple in concept—users deposit and withdraw money in to one of the agents (who usually operate in small corner shops). It also offers a gateway to loans, salary payments, and bill payments—effectively offering a banking system for the traditionally unbanked. Users transfer money between the service and a bank account. There are significantly more M-PESA outlets than ATMs, for example. In particular, its short-term 'pay bill account' service allows users to fundraise for a variety of purposes, including expenses relating to medical needs, education, and disaster relief.

M-PESA's impact in Kenya put mobile money services on the map, and there are a number of successful mobile money services around the world that are similar to or resultant from M-PESA. According to the Global Mobile Systems Association (GMSA), approximately 255 mobile money services were operating across 89 countries in as early as 2014. They are now accessible in more than 60 percent of developing markets. Sub-Saharan Africa is the region where mobile money is most widely spread, followed by South East Asia and Latin America.

The number of mobile lines in service is projected to surpass the global population at some point this year, and developing markets will continue to drive growth in mobile subscriptions for the foreseeable future.

While M-PESA and other services like it do expand opportunity and financial inclusion, mobile transfers are not a complete answer to fully participating in formal financial systems. To win back important share from Telcos, a number of banks have embarked on agency banking. Simply put, agent banking (or “agency banking”) allows humans to act as ATMs. In remote areas where people don’t have access to a bank, these agents can deliver financial services using devices such as card readers, point-of-sale (POS) terminals, or mobile phones to process real-time transactions.

Banking services offered by agents include registering customers, taking deposits, dispensing withdrawals, funding transfers, processing payments (e.g. utility bills), and providing mobile phone airtime top-ups.

As agency banking technology advances, banks are going to be able to offer more services such as loans, mortgages, and savings accounts—without having to invest in ‘bricks and mortar’ bank branch infrastructure. These huge savings in time and money can be put towards developing agency banking technology and training, allowing agents to become financial advisors to the community. New skills and up-to-date technology will enable agents to up-sell products within their local region and increase business for the banks.

Welcome to the world of digital currency where central banks can stop printing hard currencies (physical cash) and transition to using digital currencies through the development of Central Bank Digital Currencies (CBDCs).

Digital currency refers to any currency that is available exclusively in digital form and versions of a country's official currency issued by the central bank, such as the digital Yuan or Sand Dollar. Digital currencies can be used for a variety of transactions and can often be stored in digital wallets. They are designed to function as a medium of exchange, a store of value, and a unit of account. Digital currency is primarily intended to serve as money, often with the aim of replacing or complementing physical cash.

Several countries and central banks around the world are exploring or have implemented digital currencies. Here are a few notable examples that include the Chinese digital Yuan or e-GNY, officially known as the Digital Currency Electronic Payment (DCEP), being tested in several cities with plans for broader implementation across China.

The Bahamas launched the Sand Dollar in October 2020, making it one of the first fully operational CBDCs. It aims to improve financial inclusion, especially for residents in remote areas.

Sweden's central bank, the Riksbank, is exploring the e-Krona. The project is still in the pilot phase, aiming to understand the implications and potential of a digital currency in a country with declining cash usage.

Launched in October 2020, Bakong is a blockchain-based digital payment system developed by the National Bank of Cambodia. It functions as a quasi-digital currency, facilitating transactions in both the Cambodian riel and the U.S. dollar.

Nigeria launched the eNaira in October 2021, becoming the first African country to introduce a CBDC. It aims to enhance financial inclusion, reduce the cost of transactions, and improve monetary policy effectiveness.

DCash is the digital currency of the Eastern Caribbean Central Bank (ECCB), launched in 2021. It is being piloted in several member countries to enhance payment efficiency and financial inclusion.

Uruguay conducted a successful pilot of the e-Peso, a digital version of its national currency, in 2017-2018. The project aimed to explore the feasibility and potential benefits of a CBDC.

Apple Pay is not the same as mobile money, but it is a mobile payment and digital wallet service by Apple Inc. It allows users to make payments in person, in iOS apps, and on the web using their Apple devices. Apple Pay is a digital wallet service integrated with traditional banking and credit systems, whereas mobile money services are often independent financial ecosystems operated by mobile network providers.

In the U.S., Facebook allows users to send and receive money through the Messenger app and Facebook Pay, free of charge. Facebook's software plays the role of financial middleman between the sender and the receiver. It works by digitising and storing credit and debit card information and using near-field communication to facilitate secure payments.

That means that digital currencies can be integrated with mobile money systems, and such integration could enhance the efficiency, reach, and functionality of both technologies. Mobile money platforms can incorporate digital wallets that support digital currencies. Users can hold, transfer, and spend digital currencies directly from their mobile money accounts.

In conclusion, integrating digital currencies with mobile money systems holds significant promise for enhancing financial inclusion, reducing costs, and driving innovation in financial services. However, successful integration requires careful planning, robust technology, and clear regulatory frameworks.