Big Brothers are watching you. The systemic change we are going through is hugely profitable for the asset management giants, but also for the communication industry, which captures and sells our private data and leads us by the nose. Their access to all our screens and online behavior brings us close to 1984.

(Ladislau Dowbor) 1

We are amid a reorganization of our economy in which platform owners are seemingly developing power that may be even more formidable than was that of the factory owners in the early industrial revolution.

(Juliet Schor, 2020) 2

Imagine a world in which every single person on the planet has free access to the sum of all human knowledge.

(Jimmy Wales, Wikipedia, March 7, 2024)

Knowledge is immaterial, and as such obeys different rules, in comparison with material goods and services. The dominant presence of knowledge in the modern economy changes the rules.

André Gorz sums it up: “If it is not a metaphor, the expression 'knowledge economy' means important disruptions to the economic system. It indicates that knowledge has become the main productive force, and that, consequently, the products of social activity are no longer mainly products of crystallized labor, but rather of crystallized knowledge. It also indicates that the exchange value of commodities, whether material or not, is no longer ultimately determined by the amount of general social labor they contain, but, mainly, by their content of general knowledge, information, and intelligence. It is the latter, and no longer abstract social work measurable according to a single standard, that becomes the main social substance common to all commodities. It is this that becomes the main source of value and profit, and thus, according to several authors, the main form of work and capital.” 3

What the world of money and the world of knowledge today have in common is that both are, precisely, immaterial, or 'intangible', as we find in other authors. In other words, both circulate on the internet at the speed of light, in the form of magnetic signals, and in planetary space, changing the old 'territoriality', place of production, factory or farm, workers' residence, spaces of socialization. The phenomenon manifests itself broadly in the areas that are currently intertwined with communication and information, as we see in the graphs below: 4

Gigantism is linked to the basic technical characteristic that magnetic signals circulate on the planet almost instantly, and the domination of the strongest quickly becomes planetary. The degree of oligopolization of activities is evident, and here it is also about the immaterial, magnetic signals, communication and information, in which volumes, in the era of modern computers, are no longer a problem. The communication and information industry becomes dominant, generating the much-studied battle for people's attention span, with the growing chaos of real information, fake news, behavioral marketing, and surveillance systems based on the invasion of personal communications.

Even more impressive is the gradual osmosis of the subsystems of the immaterial economy, of magnetic signals, whether they represent money, knowledge, information, or communications, all having in common, in this main axis towards which the economy and the appropriation of value are oriented, the fact that they bathe the planet, reach anyone, and are controlled by a limited number of megacorporations. It is interesting in this sense that Amazon works with access to information for third parties, in addition to commercial intermediation, while in turn Amazon itself – but also Google, Facebook, Apple, Microsoft – are partly controlled by the three largest financial giants, BlackRock, Vanguard and State Street. This creates a universe of multisector control, with planetary impact.

And it is not secondary that they are also predominantly North American, and connected with the NSA and other political information systems, generating the war against Huawei, Tiktok, and other Chinese corporations: the 'markets' have become more political, politics has become more of a tool for corporations. In other words, to the rentierism that drains resources from shareholders at the top of the global financial pyramid, we must add the algorithmic control of people, and the submission of the productive universe to the logic of the shareholder with a dividend-maximizing logic, and less and less of the stakeholder. Rentierism becomes a mode of production. It does not replace traditional companies, whether industrial, agricultural, or various types of services, or even private health corporations or universities, but subjects them to its logic. It is not just a drain on resources and the formation of a powerful global rentier elite: it profoundly changes how we organize ourselves as a society.

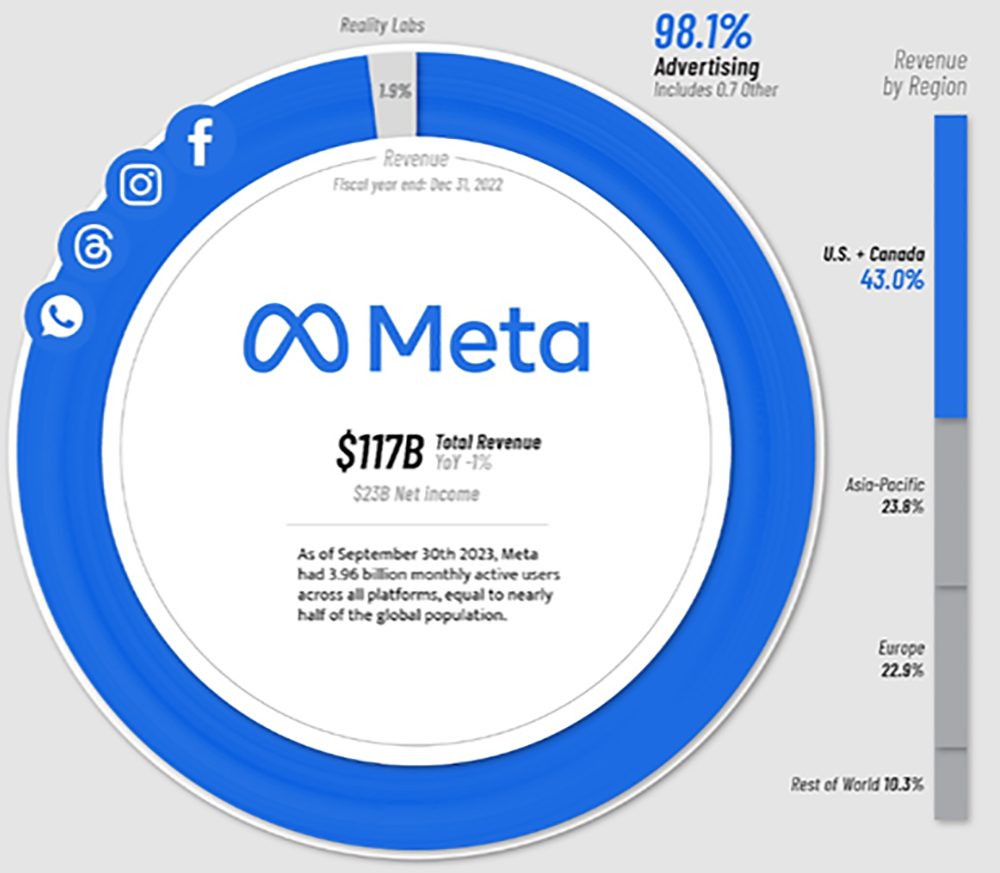

Facebook makes 98.1% of its money through advertising. It seems free to us, but the corporations pay Zuckerberg, and this money is incorporated into the costs of whatever they produce. And we pay all of it when purchasing the products of the services. In 2022, Alphabet had net profits of 21.1%, Meta 19.9%, Apple 25.3% and Microsoft 34.1%. 5 These profits are in the prices we pay. “A new report examining the causes of inflation demonstrates that corporate greed and increased CEO pay led to higher-than-necessary costs for American consumers in recent months.

The report, from the progressive organization Groundwork Collaborative, found that, in the past two economic quarters alone, 53 cents out of every dollar of inflationary price increases were due to corporate profits.” 6 In communication and similar activities involving interchange, you must use the vehicle others use, or you are isolated. This becomes a ‘demand monopoly’, and they charge what they want. Private property, in the absence of either regulation or competition, lead to a system where they lead you by the nose.

There is a huge contradiction between the fact that knowledge in its digital form can be transformed in a worldwide open-access universe, enriching everybody, and the war of top GAFAM corporations to get your attention, and to manipulate behavior. This results in the deformation of our priorities, according to corporate interests. An example is the explosion of cancer: “Over 35 million new cancer cases are predicted in 2050, a 77% increase from the estimated 20 million cases in 2022. The rapidly growing global cancer burden reflects both population aging and growth, as well as changes to people’s exposure to risk factors, several of which are associated with socioeconomic development. Tobacco, alcohol and obesity are key factors behind the increasing incidence of cancer, with air pollution still a key driver of environmental risk factors.” 7 Well, tobacco, alcohol and obesity are thriving, with powerful marketing, and individualized messages, and a huge amount of suffering.

The control of communication is also in the hands of the major asset management funds. “The sector is dominated by just three giant American asset managers – BlackRock, Vanguard and State Street, the “Big Three” – with BlackRock the clear global leader. By 2017, the Big Three together had become the largest shareholder in almost 90% of S&P 500 firms, including Apple, Microsoft, ExxonMobil, General Electric and Coca-Cola. BlackRock also owns major interests in nearly every mega-bank and major media.” 8 They are also the major shareholders of the GAFAM corporations. For the record, Larry Fink at BlackRock manages 10 trillion, while Biden’s budget is 6 trillion dollars.

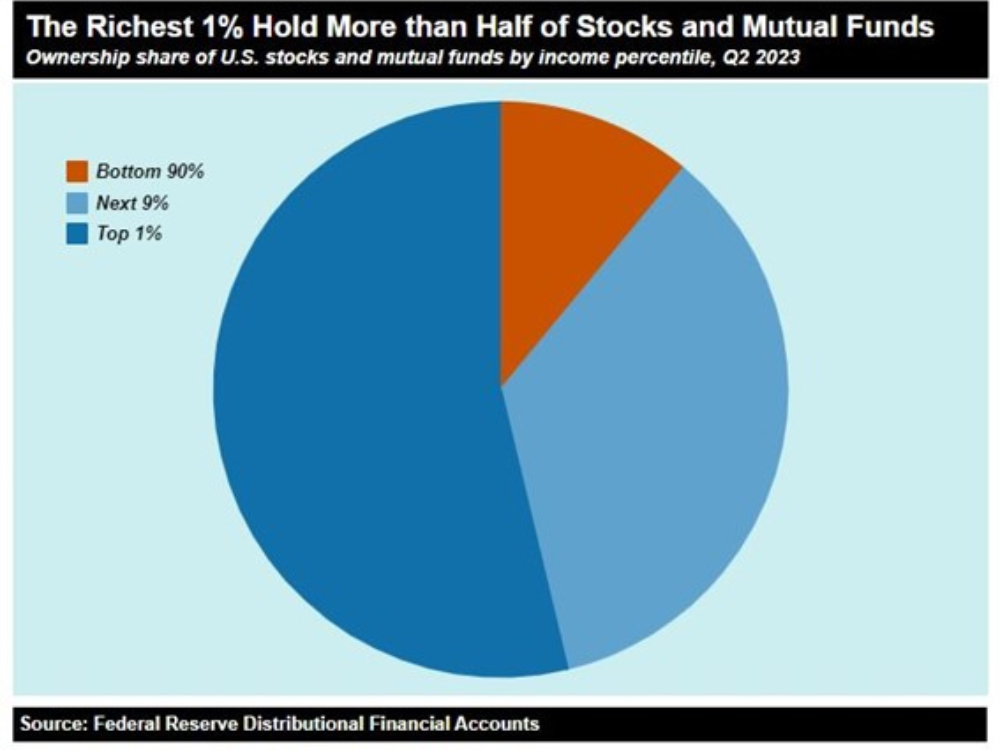

We are thus facing permanent access to our conscious attention (the attention industry), in a world-scale oligopoly, with behavioral marketing adapted to our individual characteristics, reaching billions, centered on maximizing financial returns (whatever the impact on our quality of life or the environment disasters), and funneling huge returns to the top 1%, with a high-middleclass political shock absorber in the richest 10%. Communication, private information, marketing, and finance have blended into overall social, cultural, and political control. And it is on a global scale, while attempts to regulate the system are fragmented into so many countries. We have no significant global scale regulation, even if the EU did manage to create some rules.

The figure above shows the scale of the systemic deformation we are facing. The richest 1% hold more than half of the stocks and mutual funds, which means they concentrate the flows of financial surplus drained from the whole economy. The following 9%, a political buffer of higher middle-class ‘investors’, profit as well, and make the system politically stronger. The bottom 90% do not ‘invest’, they hardly reach the end of the month, and are more frequently indebted, contributing to the system through interest rates.

Detailed data in the World Inequality Database (WID), the wealth concentration analysis by the UBS reports, the overall impact studies by Oxfam, as well as studies for specific countries, in particular indebtedness in the Global South, show how far we are from what we called the accumulation of productive capital. This is not capitalism, it is unproductive rentierism. It is not Industry 4.0, as so often mentioned, but the result of the digital revolution. Calling it ‘industry’, allows it to borrow some legitimacy from a time when producing useful goods and services was the backbone of capitalism. But it is an unproductive drain, pushing us into a social and environmental catastrophe. And we can only nod at so many customized messages we get, whether we ask for them or not.

All of this is absurd, considering, as Wikipedia’s Jimmy Wales comments, that these technologies could allow us to have intelligent access to what we effectively want. As for the financial giants, well, it is our money, but out of our hands, and so many communities are regaining control.

Notes

1 L. Dowbor, The Attention Industry, Meer, October 2023.

2 Juliet Schor, After the Gig: how the sharing economy got hijacked, and how to win it back, University of California Press, 2020, p. 151, quoting Martin Kenney and John Zysman.

3 André Gorz, L’immatériel, 2003.

4 TNI, Transnational Institute, Big Tech: the rise of GAFAMT, 2023.

5 Pallavi Rao, Visualizing how Big Tech Companies Make their Billions, Visual Capitalist, December 18, 2023.

6 Chris Walker, Greedflation, Truthout, January 22, 2024.

7 WHO, Global Cancer Burden Growing, Press Release, February 1, 2024.

8 Ellen Brown, Meet BlackRock, June 21, 2020.