We inherited global governance institutions from the end of WWII. That’s over three-quarters of a century, a time with so many structural changes in the world, so many new countries, new technologies, global connectivity, virtual money, huge financial and communications platforms, world-scale corporations, cyber war, drone killings, massive migrations. What we inherited from Bretton Woods, the UN, IMF, World Bank, WTO and other international institutions basically produce meetings and reports. The global governance gap is dangerous. And the US trying to fill the void alone will not work.

(Ladislau Dowbor)

Trying to save the past is not an option. We did have the thirty golden post-war years and an institutional framework that made this huge progress possible, although in only a group of countries. This is not to be discarded: progressive tax systems to reduce inequality, a reasonable balance between government, business and civil society, and the Universal Declaration of Human Rights to give us an ethical anchor. Open colonialism gradually withered, and the West presented itself as the good guys. Industrial capitalism, with democracy and impressive technological progress, could be seen as the future. Poor countries, the immense majority, had a model to follow: they were just at another stage, late-comers, and the road seemed clear. But the world has changed.

The balance between public and corporate interest was rapidly eroded in the eighties, with what we called ‘the lost decade’ because of slow growth, but presently understand as a restructuring of the leading economies, from industrial capitalism to financial global control. In politics, the shift became evident with Ronald Reagan and Margareth Thatcher, but in the economic bottom-line financial globalization was rapidly taking over. The Declaration of Human Rights was substituted by “business of business is business”, and “greed is good”. When John Ruggie managed a formal agreement on U.N. Guiding Principles on Business and Human Rights (2005), the global economic system was already at another age. We presently call it financialization. The financial corporations generated the 2008 crisis but already had enough clout to make governments pay for it, in the US as in Europe.

Money printed by governments migrated to virtual money emitted by banks, while the dollar, free from the gold-exchange guarantee, conquered the world, paying for trade, ensuring reserves in central banks and funding American military bases and wars. With financialization, huge fortunes are extracted from the real economy through interest rates, dividends and tax evasion, making productive businesses and governments pay the financial costs. BlackRock alone manages over US$10tn, not with banking but with “asset management”. Larry Fink didn’t need to be elected. Joe Biden’s budget, the federal budget of the United States of America, is US$6tn. Thomas Piketty’s huge success results from his clear presentation of the new system: financial rentierism pays much more than investment in productive activities, and money goes to where it pays more. Present capitalism is basically an extractive system benefitting unproductive middlemen. It is a global financial system with no regulation, no taxes, no information on their activities – except marketing and brand-building – and widely relying on tax havens, escaping practically any legislation. Free-floating global financial managers. Ruggie’s study on the new system, Just Business: Multinational Corporations and Human Rights (2013) is much more down to earth.

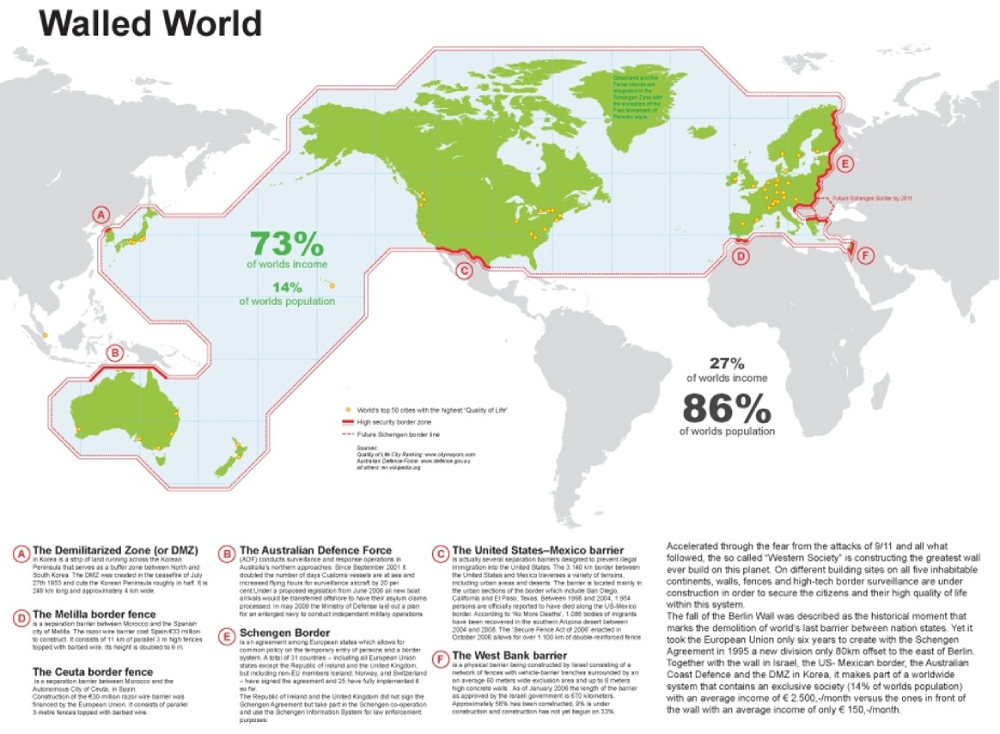

Global gains through interest rates, dividends, tax evasion, derivatives, commodity price-fixing, natural resources appropriation, privatizations, monopoly prices and other forms of rent exploded in the world, generating most of the fortunes, and leading to a wealth concentration no one would have imagined a few decades ago. Inequality became, together with the environmental catastrophe, a key world challenge, leading not only to hunger and suffering but to a fractured global structure. Imprecise as it may be, the map below is impressive. We are facing a walled world:

These are 2018 numbers, but we are interested here in the structural aspect, and this has not changed. Basically, 14% of the population, the global West, gets 73% of the income, while the rest of the world, 86% of the population, gets 27%. If we take China out, the numbers are much worse. This is the world of under-developed countries, promoted to “developing” countries by the UN, but with little change. The comparison to the gated communities where the rich protect themselves in our cities is interesting: a walled world indeed. With heavily protected gates.

Brazil provides an interesting example. Top technologies applied to exports of commodities, grain, timber, crude oil, meat, iron ore and other minerals, leading to a reprimarization of the economy and de-industrialization, leading to a kind of high-tech colonialism. Exporting crude natural resources is a drain on the economy, a form of decapitalization. Since 1996, primary sector exports are tax exempt. A second drain is based on financial rentierism, through exceptionally high-interest rates on public as well as private debt. In 2023, for an inflation of 5%, the public debt is paying 13.75%, while families pay an average of 55.8% and businesses 23.1%. This is structural usury, leading to a radical increase in inequality, and a more powerful billionaire elite, linked to the global commodity and financial world-scale giants. Their income is also tax-exempt, since 1995.

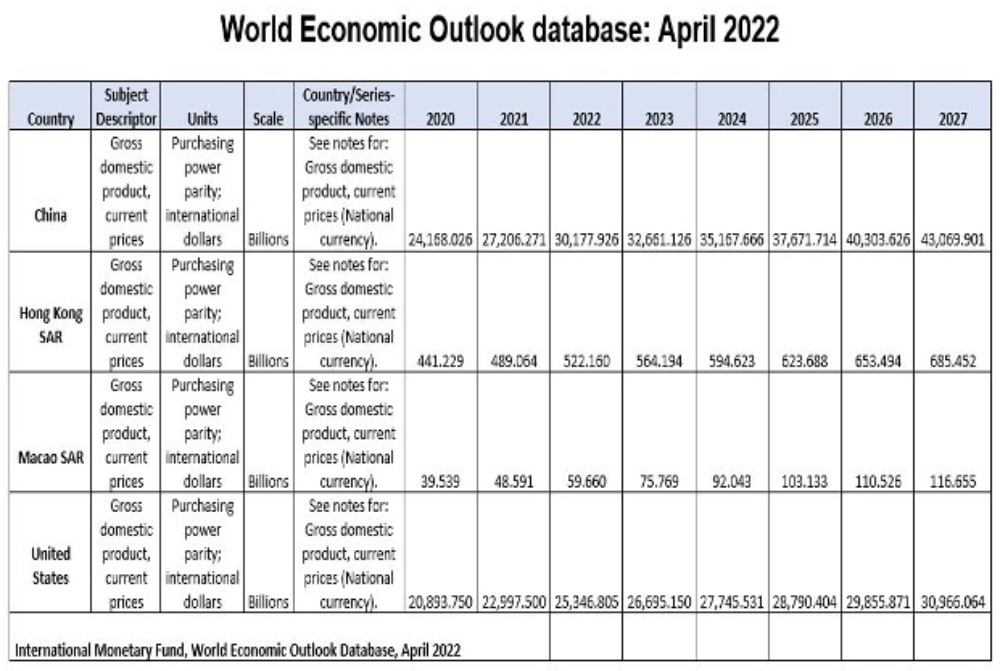

We can extend this line of thought to so many countries in Latin America, Africa, and Asia. Commodity dependence and financial drains simply do not work. It is not the case for China, presently the first economy in the world in Purchasing Power Parity, which measures effective production levels, without the dollar conversion deformation. In 2022, China's GDP reached US$30.2tn, while the US reached US$25.2tn.

The numbers are impressive, considering how recently China emerged from the global political and corporate control system. But what interests us here is that with China, the third-world countries are seeing a chance to generate a global power shift. This is not just a question of on what side a country is, in the US/China tensions. The very fact that there is an alternative changed negotiation power for all the countries that just had to accept whatever the West offered them. And it has to be seen from a broader point of view: Capitalism, in its rentier version, with deepening inequality and explosive environmental challenges, has lost its appeal unless you are in the rich club.

On a visit to China in April 2023, Lula stated he wanted to strengthen friendship with China, as well as with the US: Brazil is a nation, it does not have to “belong”. With the BRICS and many more countries interested, the trend already represents over half the world population. The New Development Bank, under the presidency of the former president of Brazil Dilma Rousseff, opens a different set of relations than the US-dominated IMF. Most importantly, more countries will have commercial transactions without depending on the dollar, gradually reducing the money-emission power the US has wielded to fund its interests abroad. This is not a question of whose side we are on, but of a more balanced power distribution, opening opportunities beyond the happy few. For countries that do not belong to the Global North, distributed dependence could mean a lot.